Ira Income Limits 2024 Magi. If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000. In 2024 the maximum roth ira contribution amount begins to be.

Single, head of household, or married filing separately if you did not live with your spouse at all during the year. Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you’re age 50 or older) depends on your tax filing status and your.

The Roth Ira Income Limit To Make A Full Contribution In 2024 Is Less Than $146,000 For Single Filers, And Less Than $230,000 For Those Filing Jointly.

Earning spouse can open and.

$7,500 (For 2023) And $8,000 (For 2024) If You're Age 50 Or Older.

Ira contribution limit increased for 2024.

If You Are Married And Filing.

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

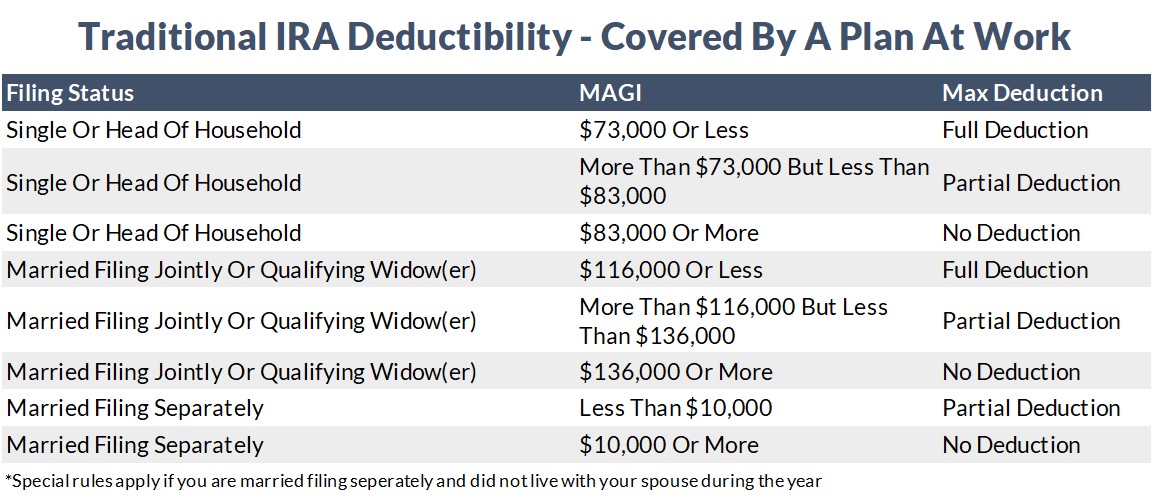

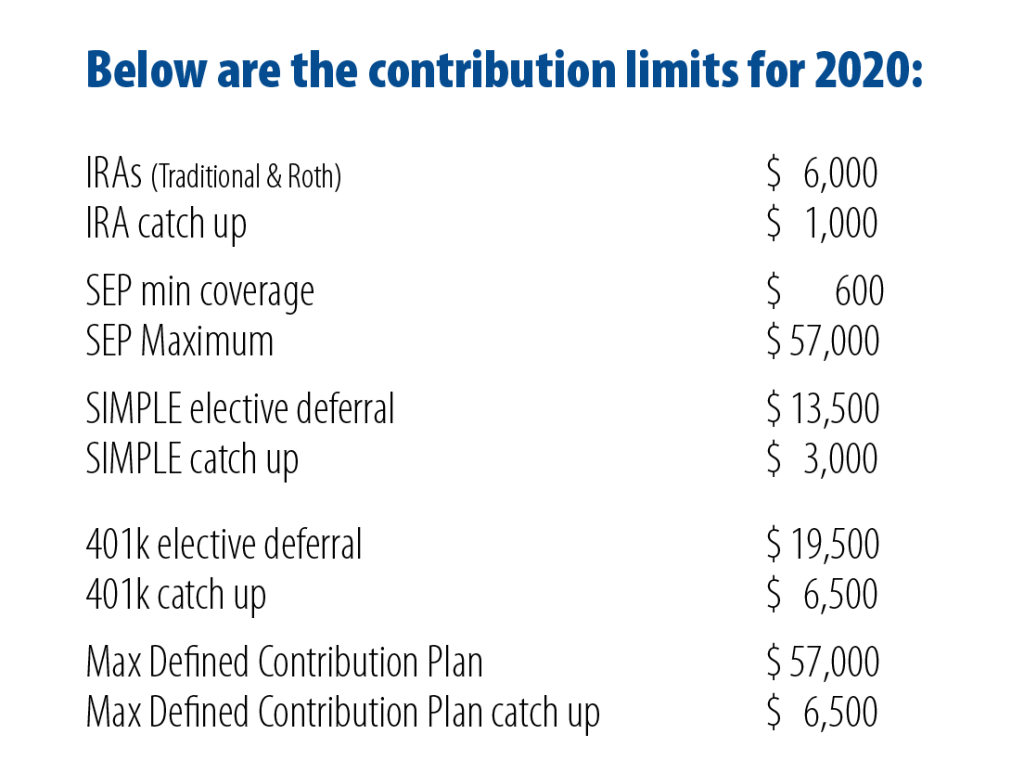

ira contribution limits 2022 Choosing Your Gold IRA, If your magi was $73,000 or less, you could deduct that full $6,500 from your taxable income. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: joleenwbianka.pages.dev

Source: joleenwbianka.pages.dev

Tax Deductible Ira Limits 2024 Brooke Cassandre, This annual contribution limit is higher in 2024, with the roth ira contribution limit being $7,000. If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or.

Source: meldfinancial.com

Source: meldfinancial.com

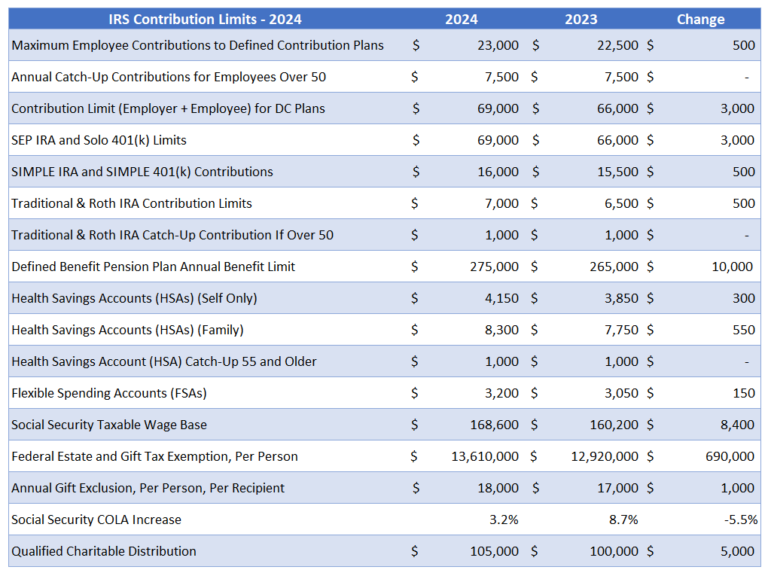

IRA Contribution Limits in 2023 Meld Financial, The roth ira contribution limits in 2024 were raised to $7,000, or $8,000 for taxpayers 50 and older. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024.

Source: joleenwbianka.pages.dev

Source: joleenwbianka.pages.dev

Tax Deductible Ira Limits 2024 Brooke Cassandre, $7,500 (for 2023) and $8,000 (for 2024) if you're age 50 or older. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

Source: inflationprotection.org

Source: inflationprotection.org

2024 ira contribution limits Inflation Protection, Single tax filers must have a modified adjusted gross income (magi) of less than $153,000 a year in 2023 or $161,000 a year in 2024. The roth ira contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, The roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for. Single tax filers must have a modified adjusted gross income (magi) of less than $153,000 a year in 2023 or $161,000 a year in 2024.

Magi Medicare Limits 2024 Marcy Sabrina, Ira contribution limit increased for 2024. Single, head of household, or married filing separately if you did not live with your spouse at all during the year.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRA Tax Deduction Retirement Limits Darrow Wealth Management, In general, you can contribute up to $7,000 to an ira in 2024, or up to $8,000 if you’re 50 or older. You can make 2024 ira contributions until the.

Source: denyqmelina.pages.dev

Source: denyqmelina.pages.dev

Maximum Ira Contribution 2024 Married Filing Jointly Ellen Hermine, You may contribute up to the annual limit if your. The calculator will allow you to input any existing retirement accounts and savings you have, including 401 (k)s, 403 (b)s, 457 (b)s, iras, and pensions.

You're Allowed To Invest $7,000 (Or $8,000 If You're 50 Or Older) In 2024.

What are the income limits for roth iras in 2024?

The 2024 Contribution Limits For An Ira Are As Follows:

The rmd amount has to be distributed from the traditional ira and included in gross income.